- Condition Note: no pen/pencil marks

About the Book:

Banking IS AN ESSENTIAL INDUSTRY TO MOST OF US. IT IS WHERE WE OFTEN WIND UP WHEN WE'RE SEEKING A LOAN TO PURCHASE A NEW AUTOMOBILE, TUITION FOR COLLEGE OR TRADE SCHOOL, FINANCIAL ADVICE ON HOW TO INVEST OUR SAVINGS, CREDIT TO BEGIN A NEW BUSINESS, A SAFE DEPOSIT BOX TO SAFEGUARD OUR VALUABLE DOCUMENTS, OR EVEN MORE COMMONLY, A CHECKING ACCOUNT OP CREDIT CARD TO KEEP TRACK OF WHEN AND WHERE WE SPEND OUR MONEY.

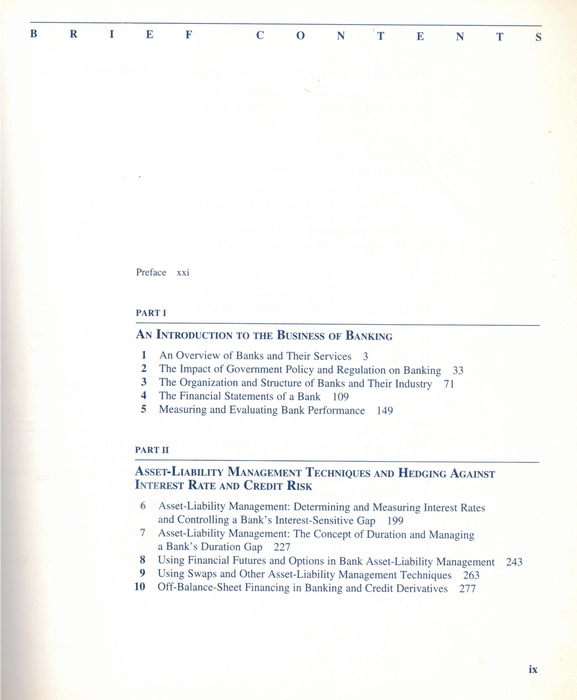

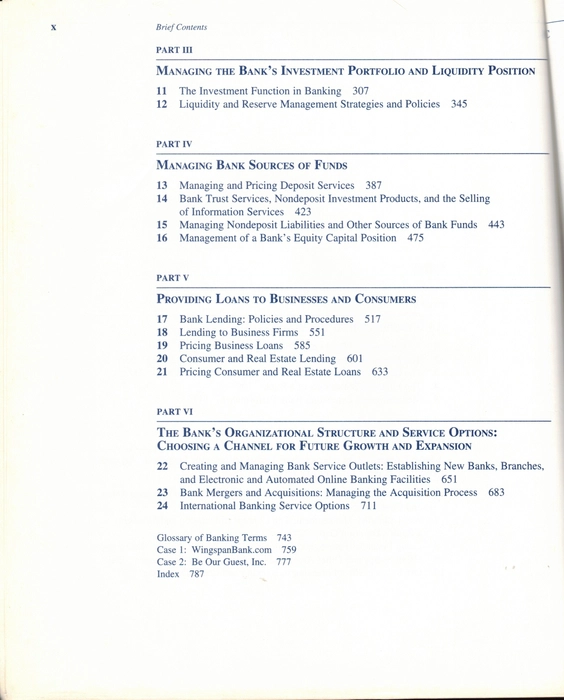

In the fifth edition of Commercial Bank Management we have:

- A new and in-depth discussion of the Gramm-Leach-Bliley (or Financial Services Modernization) Act that will allow all banking firms to combine with security and insurance firms to form highly diversified ("one-stop shopping") financial conglomerates.

- A more in-depth discussion of interstate banking and the 1994 Reigle-Neal Interstate Building Act, which now allows banking companies, both foreign and domestic, to reach across state lines and acquire banking firms (subject to regulatory approval) in any of the 50 states of the United States. The reader needs to know what the possibilities are for future bank expansion in the United States and also what the research evidence is on the effects of interstate, increasingly nationwide, banking in the United States.

- A sharply expanded exploration of the rise of Internet banking through the World Wide Web that has opened up all kinds of service and information opportunities for bankers and bank customers.

- Even more than in the preceding editions this latest edition examines the challenges bankers face from every direction from nonbank competitors - credit unions, savings and loans and other thrifts, check-cashing and small loan companies, mutual funds, security brokers and dealers, insurance companies, and pension plans.

- New ways of managing a bank's liquidity needs have emerged along with further changes in Federal Reserve rules for managing a bank's legal reserve (money) position.

- Further exploration of what exactly is happening in the bank merger and acquisitions field as banking firms all over the globe reach out to acquire ever-expanding numbers of other banks, thrift institutions, insurance agencies and underwriters, credit-card companies, security brokers and dealers.

- Added Internet exercises and URLs to each chapter to engage the reader in the banking issues that have arisen with the growth of the World Wide Web.

- Author: Peter S. Rose

- Publisher: McGrawHill (2002)

- Language: English

- Format: Paperback

- ISBN: 9780071121224